Need help? Visit our Help Center or get 24/7 support from real humans

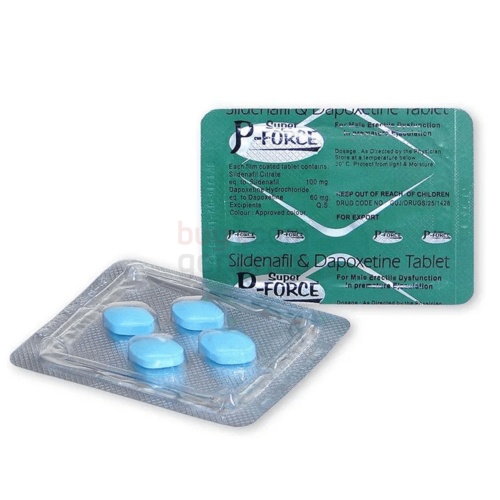

Tell us what medication you need. We'll find the lowest price for its generic version from India. Our prices start as low as $0.59 per pill compared to an average price of $20 at your local US pharmacy.

We proudly offer a variety of treatments for diabetes, antivirals, migraines, skin care, antibiotics, ED and premature ejaculation, cognitive enhancers, pain management, and sleep aids to quickly find the ideal solution for your health needs.

$0

Your Health, Tailored: Find the Perfect Generic Meds at Lowest Prices

Browse our selection of generic medications with options for diabetes, antivirals, migraines, skin care, antibiotics, ED pills, cognitive enhancers, pain relief, and sleep aids to quickly find the best match for your health needs.

Credit Card Payments, KYC & Billing FAQ

We accept major debit/credit cards, including MasterCard, American Express, Visa; local bank transfers, Zelle, Venmo, ACH transfers, eCheck, Bill Pay, Apple & Google Pay, eCheck, PayPal, bitcoin, altcoins, stablecoins like USDC or USDT, and other cryptocurrency. When you reach the checkout page, you’ll see the payment methods that are currently available. Please note that not all options are available at all times, as their availability may change dynamically based on various factors.

If you tried to place an order but your card was declined and you didn’t receive an order confirmation email, please review this page carefully before contacting our customer support team. The information provided here is the same information our support team would provide to resolve your issue.

Let's Go Over Some Important Details

Banks & Big Pharma Try to Block Us — We Find a Way

Payment processors make it tough, but we’ve built smart workarounds. For privacy, your statement will show a generic purchase. With Bitcoin and other cryptocurrencies, payments are always private—plus, you get an instant 20% discount when you pay with Bitcoin directly.

How We Accept Credit Cards

Card payments are processed through regulated crypto on-ramp providers. Your payment is converted into cryptocurrency (USDC) and follows international compliance rules, which may require KYC verification decided by the payment provider. All personal data is submitted directly to them — we never store or access it. When using the credit card on-ramp option, please ensure your payment does not exceed $500 USD (approximately €460 EUR, £395 GBP, or A$760 AUD). This service is designed for quick, low-value cryptocurrency purchases.

Tips for Paying with Credit Cards

① Turn off VPN or proxies ② Use your own card and real details ③ Ensure your billing info (address, phone, ZIP) matches your bank records ④ Upload clear ID and selfie if requested ⑤ Avoid multiple failed attempts ⑥ Refunds must be requested from our store, as banks cannot reverse crypto payments ⑦ Do not describe the purchase as “Rx” or medication: this triggers automatic bank blocks. Treat it as a regular online purchase.

Table of Contents

Why is KYC required for card payments?

We get it — being asked for personal data feels uncomfortable.

Here’s the straight answer, no nonsense.

When you pay by credit or debit card, your payment is processed as a cryptocurrency purchase (USDC) behind the scenes. This is called an on-ramp transaction.

Because fiat money is being converted into crypto, global regulations apply. Governments in the US, EU, Australia, and other regions require identity verification to prevent money laundering and terrorism financing. There’s no workaround — every compliant crypto on-ramp follows the same rules.

Additionally, cryptocurrency transactions are irreversible. This creates an extra layer of protection for crypto providers against chargebacks and fraud. Since payments cannot be reversed like regular card transactions, on-ramp companies must apply stricter verification and risk controls before approving a purchase to protect both their systems and the broader financial network.

That’s why our payment partners may ask for KYC (Know Your Customer) verification.

KYC is required only when you choose to pay by card via our on-ramp partners (for example, Stripe, MoonPay, etc).

On-ramps usually apply two verification levels:

- Light KYC: Email verification and basic personal details (such as an ID or SSN number, depending on country).

- Full KYC: Everything above, plus identity documents and a short live selfie (liveness check).

Which level is required is decided entirely by the payment provider and purchase amount, based on their internal risk checks. We do not control this.

Not us. Ever.

All personal information is submitted directly to the payment provider (Stripe/Link/Paybis/MoonPay/Ramp Network, etc). We never receive, store, or access your KYC documents.

They are regulated companies and fully compliant with GDPR and local data-protection laws.

Because EU crypto laws (MiCA and AML regulations) require payment providers to apply stricter identity and risk checks for all on-ramp transactions. Common decline reasons include VPN or location mismatch, incomplete or failed KYC, billing details not matching bank records, higher-risk merchant categories, and internal risk scoring by the payment provider.

Hi, I'm John. And today I'm gonna walk you through exactly how our credit and debit card payments work using a regulated crypto onwrap. If you've ever wondered why there are a few extra steps when paying by card or why identity verification might be required. This video will explain everything clearly and simply. Let's get started. First, let's place an order on one of our websites. For reference, we will use modafinilxl dot com. When you pay with your debit or credit card on our website, your payment isn't processed like a typical online store transaction. Instead, it goes through what's called a crypto on ramp provider. An on ramp is a regulated financial company that converts regular money like US dollars, Australian dollars, euros or British pounds into cryptocurrency. In our case, that cryptocurrency is usually USDC, a stable digital dollar. Here's what happens behind the scenes. You enter your card details, the on ramp provider charges your card. They convert that amount into USDC, And that crypto payment completes your order. It sounds technical, but for you, it simply feels like paying online with a few extra steps. Because your payment is technically a cryptocurrency purchase. Global financial regulations apply. Governments in the US, EU, Australia and many other regions require identity verification when converting traditional money into crypto. This is known as KYC, know your customer. This isn't our rule. It's required by the regulated payment providers we work with. Depending on your country or transaction size, you may be asked to confirm your phone number, upload government ID, take a quick selfie, confirm your billing address. All of this information goes directly to the payment provider. We do not see it, store it or access it. Here's what you can expect. Step one, select the crypto on ramp payment gateway. Please note the important KYC requirements. Turn off your VPN, use a billing address that matches your bank records, and use your own card. Step two, complete phone verification if prompted. Step three, upload ID and complete selfie verification if required. Step four, after passing KYC, enter your card details on a third party on ramp platform. Your card will be charged and your order will be confirmed. Most users complete this process within a few minutes. We understand it can be frustrating if your card is declined, but here are the most common reasons. Using a VPN or proxy, billing address not matching bank records, using someone else's card, multiple rapid attempts, unclear ID uploads, bank blocking foreign or crypto related transactions. Because crypto transactions are irreversible, on prem providers apply stricter fraud controls than traditional card processors. To improve your approval chances, turn off VPNs, use your exact billing details, use your own card, Avoid retrying multiple times. Upload clear, well lit documents. If your bank blocks the payment, simply call them and authorize the transaction. Most on ramp providers allow quick purchases of up to around six hundred US dollars approximately or the equivalent amount in your local currency for new accounts. However, there is no strict universal limit. In some cases, transaction amounts may still be approved depending on your verification level, region, and risk profile determined by the payment provider. Higher limits may require additional verification. Card payments are typically processed instantly once approved. Bank transfers and other local methods may take longer depending on your bank. Your billing statement may show a generic descriptor instead of our store name. If you prefer not to complete identity verification, many customers choose to pay directly with Bitcoin or other cryptocurrencies instead. When you already own crypto, there is no on ramp involved. That means no ID uploads, no phone verification and no bank authorizations. Bitcoin offers several advantages. First, no middlemen, no bank approvals or foreign transaction blocks. Second, greater privacy, no documents submitted to payment processors. Third, better pricing. Because crypto reduces processing costs and fraud risk, we pass those savings to you. Which is why Bitcoin orders receive up to a twenty to thirty five percent discount at checkout. Many customers try it once and stick with it. If you prefer paying by card, our regulated onramp partners make it possible. Just follow the verification steps and you're good to go. If you prefer speed, privacy and larger savings, Bitcoin may be the better option. Either way, we are here to help. If you have questions, contact our support team and we'll guide you step by step. Thanks for watching and we look forward to helping you complete your order.

Payment Tips & Best Practices

Turn Off VPN & Proxies

Use your real location, which should match your billing address. VPNs often trigger automatic blocks. Avoid rushing or repeatedly retrying, as multiple failed attempts may result in a temporary lock.

Use Your Own Card & Real Details

The card name, IP location, and identity must all match. Your name and date of birth must exactly match those on your ID.

Good Lighting for Selfies & Clear Docs

If you are asked to complete KYC, make sure that you are not wearing hats, glasses, or filters. Follow the on-screen instructions and upload clear documents. The documents must be clear, with no blur, cropped edges, or screenshots.

Age, Region & Profile Matter

Approval depends on age, region, and profile. EU users face stricter rules. Some verifications may be automatically declined due to regulatory requirements. If this happens, wait a while, turn off your VPN, clear cache, and try again.

Billing Descriptor & Processing Time

Card payments are usually processed instantly, while Zelle and local bank transfers may take up to 72 hours if pending with your bank. Your statement may show a generic or different business name instead of our store name.

Yes, We Usually Accept PayPal Payments As Well

There Is an Additional Fee for PayPal. This Is Because of the Additional Transaction Fees Charged by PayPal

Because of PayPal's restrictions on online pharmacies, we use third-party payment processors that charge significant fees. As a result, PayPal payments are subject to a 10% surcharge per transaction. Unfortunately, our discount codes do not apply to PayPal transactions. As an alternative to avoid these extra fees, we recommend using Bitcoin for your payment. Bitcoin transactions are not only easier and free of extra fees, but they also qualify you for a 20% discount on your entire purchase!

Please Don't Send More Than One Payment via Paypal

We do not recommend making multiple payments for a single order through PayPal, as our system cannot process refunds through this service. Unfortunately, PayPal has strict rules that prohibit transactions with online pharmacies, covering both incoming and outgoing payments. These rules are beyond our control.

Why Are You Unable to Process Refunds Through PayPal? What Should I Do If I Need a Refund?

Our unique payment acceptance method prevents us from processing refunds through PayPal. Although PayPal technically supports refund processing, issuing refunds for transactions from BuyGenerics may result in the permanent suspension of your PayPal account due to their strict policy against online pharmacies, which prohibits transactions with such businesses. We have no control over PayPal's policies. As an alternative, you may opt for a store credit. Please contact our support team to arrange a store credit for your purchase. This credit is versatile, applicable to any future purchase from our store, and has the same value as cash on our website.

To avoid suspension of your PayPal account, ensure that your transactions complete successfully and avoid situations where you may need to request a refund. If a refund is necessary, opt for a store credit rather than a direct refund to your PayPal account.

Yes, we offer several other payment options, including credit/debit cards, ACH Payments, Bill Pay, e-Check, Zelle, and Bitcoin.

If you have successfully completed a PayPal transaction but have not received an order confirmation email, we recommend that you contact our customer support team. When contacting us, please include your PayPal transaction ID as text in the body of your message, rather than sending it as a screenshot.

Bitcoin Payments Made Easy for You

Here Are Some Benefits of Using Bitcoin

No Middlemen

Because Bitcoin transactions are peer-to-peer, there are no banks or middlemen involved. This often results in faster transactions and lower fees. In terms of discounts, we offer a 20% discount on all purchases made using Bitcoin, as the savings we make through lower transaction fees are passed on to you.

Ultimate Privacy

Transactions conducted with Bitcoin tend to offer greater privacy than those conducted with traditional payment methods. Although every Bitcoin transaction is recorded on the blockchain, the identities of the people involved in those transactions remain anonymous. In terms of ease of use, once your Bitcoin wallet is set up and you've purchased some Bitcoin, conducting a transaction is as simple as sending an email.

As Easy as Sending an Email

We know that Bitcoin can seem daunting if you're new to it, but don't worry, we've got your back! To help you get started with Bitcoin, we offer a quick and easy video tutorial. In addition, our support team is always ready to help you with any challenges you may encounter. Why not give Bitcoin a try? You might find it's easier than you think!

What Is the Difference Between Visa and Mastercard?

In the realm of online transactions, the choice between Visa and Mastercard holds significant weight, especially when it comes to purchasing drugs online. These two financial giants, while sharing global prominence, exhibit subtle differences that can shape your decision-making process.

One crucial aspect to consider is how these cards handle currency conversion, especially when dealing with international purchases. Visa and Mastercard employ their distinct exchange rates when conducting transactions in foreign currencies. Understanding these variations can help you optimize your drug buying experience, ensuring you get the best value for your money.

Besides, both networks come with their array of perks and benefits, making the choice a bit nuanced. Visa, for instance, offers several incentives like comprehensive travel insurance, extended warranties on purchases, and enticing reward programs. On the other hand, Mastercard steps up its game by providing exclusive price protection, shielding you from unexpected price drops, robust identity theft protection, and access to a range of exclusive events. Evaluating these benefits is indeed in line with your lifestyle and preferences.

Additionally, the digital landscape demands robust security measures, and both Visa and Mastercard excel in this regard. Visa employs the formidable Verified by Visa system, an additional layer of security that safeguards your online purchases. Mastercard, not to be outdone, integrates SecureCode, an advanced authentication method that enhances the safety of your transactions. Understanding the security nuances of each network can provide you with peace of mind, ensuring your financial data remains confidential and secure.

In essence, both Visa and Mastercard stand as stalwarts of convenience, security, and global acceptance, making either choice suitable for your online transactions. Your decision could pivot on your personal preferences, existing affiliations with financial institutions, and the specific benefits that align with your lifestyle.

If the Payment Fails, What Should I Do?

Encountering a payment failure during your online purchase can be frustrating, but rest assured solutions are readily available. Here’s what to do if your payment fails at BuyGenerics online pharmacy:

- double-check your payment information: Start by revisiting the payment details you entered. Ensure your card number, expiry date, CVV, and billing address are accurate. Even a minor typo can lead to payment failure;

- verify sufficient funds: Confirm that your account or card has enough funds to cover the transaction. Insufficient balance is a common reason for payment failures;

- contact your bank: If your card is declined, it could be due to your bank’s security measures. Banks sometimes block international transactions or online payments as a precaution against fraud. Contact your bank to verify if it is blocking the transaction and request the representative to allow it;

- use an alternative payment method: If one payment method fails, consider using an alternative. BuyGenerics accepts various payment options like credit cards, cryptocurrencies, or Zelle. Explore these alternatives to complete your purchase;

- reach out to customer support: If you are unable to resolve the issue, don’t hesitate to contact our customer support team. We have experienced professionals who can guide you through the payment process, troubleshoot issues, and ensure a smooth transaction;

- check for technical errors: Sometimes, technical glitches on the website or payment gateway can lead to payment failures. Refresh the page and clear your browser cache. If the problem persists, inform the customer support team about the specific error message you received;

- consider using a different device or network: Sometimes, device or network issues can interfere with the payment process. Try using a different device or switch to a more stable internet connection to see if the payment goes through;

- be cautious with multiple attempts: While it’s essential to resolve the payment issue promptly, avoid making multiple attempts in quick succession. Some financial institutions might interpret this as suspicious activity and block your card for security reasons. Allow a reasonable amount of time between attempts;

- review the order and payment policy: Take a moment to review our e-pharmacy’s payment policy. Ensure you are complying with our terms and conditions regarding accepted payment methods and international transactions.

By following these steps and staying patient, you can effectively troubleshoot payment issues and proceed with your order. Remember, our customer support team is there to assist you, so don’t hesitate to reach out for personalized guidance in case of any payment issue.

Is There a Limit on Debit Card Payments?

Debit card spending limits, a safeguard put in place by your bank or credit union, can significantly affect your financial transactions. Every debit card has a maximum spending limit, ensuring that your expenditures align with your account balance and financial history. This limit is set by the institution issuing your card and can vary depending on the type of account you hold.

Attempting to make a purchase exceeding this maximum will result in your debit card being declined, even if there are sufficient funds in your account.

It’s crucial to know your limit, and fortunately, most banks are flexible. If you need a higher spending limit, most institutions will raise it upon your request. However, this increase can be either permanent or temporary, depending on your needs.

Moreover, the implementation of these limit adjustments can vary. Sometimes, your increased limit is instantaneously active. In other cases, it might take 24 to 48 hours to reflect in the system. Being aware of this timing is vital, especially if you’re planning a significant purchase right after contacting your bank.

This proactive step ensures that your significant transactions go through smoothly, offering you the flexibility you need in your financial transactions.

Here’s a glimpse into the debit card purchase limits from several major financial institutions:

- Alliant Credit Union: $300 to $2,000;

- Ally: $5,000;

- Chase: $400 to $7,500;

- Citibank: $5,000 to $10,000;

- Wells Fargo: $600 to $10,000.

Notably, some banks offer specialized accounts with higher withdrawal limits, and specific debit card options might have distinct spending caps. To know the exact limit for your card, contacting your financial institution is essential.

What Is Altcoins? Can You Pay Using This?

In the dynamic realm of online payments, the term “Altcoins” has gained significant traction, especially within the cryptocurrency community. Altcoins, short for alternative coins, refer to all cryptocurrencies other than Bitcoin. While Bitcoin paved the way for digital currency, Altcoins diversified the landscape, offering unique features and applications to crypto enthusiasts globally.

At BuyGenerics online pharmacy, we are at the forefront of financial innovation, embracing the future of transactions.

In addition to Bitcoin, both on-chain and lightning network, we proudly accept a plethora of Altcoins, including but not limited to Ethereum (ETH), Ripple (XRP), Monero (XMR), Cardano (ADA), Binance Coin (BNB), Litecoin (LTC), Bitcoin Cash (BCH), and Dogecoin (DOGE). These Altcoins represent the pinnacle of cryptocurrency innovation, each with its distinctive strengths, making them more than just alternatives but powerful digital assets in their own right.

If privacy is a paramount concern for you, these cryptocurrencies offer advanced features ensuring your transactions remain confidential. Altcoins often integrate cutting-edge technologies. For instance, Ethereum, a leading Altcoin, enables smart contracts and decentralized applications (DApps), expanding the horizons of what’s possible in the digital realm.

In addition to Altcoins, our e-pharmacy accepts stable coins such as USDT (Tether) and USDC (USD Coin). These coins are pegged to stable assets like the US dollar, ensuring your transactions remain unaffected by the volatility often associated with other cryptocurrencies.

What’s more, when you opt for any of our cryptocurrency payment options, including Altcoins, you unlock an exclusive benefit.

All crypto payments come with an enticing 20% discount. It’s our way of appreciating your trust in our services and embracing the future of finance together.

Which Payment Method Should I Choose?

Choosing the right payment method depends on your preferences and priorities. If you value convenience and widespread acceptance, credit or debit cards, especially Visa and Mastercard, are excellent choices. They are accepted globally and offer secure transactions. If you prioritize privacy and decentralization, cryptocurrencies like Bitcoin or Altcoins provide a viable alternative. These digital currencies ensure anonymity and can be used for online payments on platforms that accept them.

Ultimately, the choice of payment method boils down to your comfort level with technology, your need for privacy, and the specific options and benefits provided by the online pharmacy such as discounts.

Looking for discount coupons and exclusive offers?

Receive an instant $10 discount on your purchase

Sign up for our newsletter to get access to exclusive online deals, special offers, coupons, and pre-sale events. We prioritize your inbox peace - expect only two emails a year from us (like during our Black Friday sale), and you have the freedom to unsubscribe at any time.

Buy Generics – Affordable Online Pharmacy & FDA-Approved Meds

Affordable Online Pharmacy & FDA-Approved Meds

At BuyGenerics.com we stand as the leading online destination for generic prescription medications. Our wide selection includes but is not limited to Ivermectin, Zopiclone, Fluconazole, Metronidazole, Hydroxychloroquine, Azithromycin, Finasteride, Doxycycline, Carisoprodol (Soma), Tretinoin and Gabapentin. We’re committed to providing you with the highest quality as well as most competitive prices so you get the best value for your healthcare dollar.

Your privacy and security are of the utmost importance to us, which is why we’ve implemented advanced security measures to maintain your confidentiality and protect your personal information throughout the order process.

BuyGenerics is your reliable provider for shipping FDA-approved medications directly from India to your doorstep, discreetly and efficiently.

In appreciation of your choice to trust BuyGenerics, we’re pleased to offer a special introduction to our quality products with 30 free ED pill samples, including Cialis, Viagra, and Levitra. To take advantage of this offer, simply request “Free ED Samples” in the comments box during checkout and we’ll add this gift to your purchase.

Choose from our bestsellers available for international shipping and select products such as ED pills or modafinil shipped within the USA via USPS, the UK via Royal Mail, or Australia via Australia Post.

BuyGenerics.com

1705 Edgewater Dr

Orlando, FL 32804

United States

Shipping FAQ

BuyGenerics provides a hassle-free shopping experience for our customers around the world, especially serving the USA 🇺🇸, UK 🇬🇧 and Australia 🇦🇺 with customized shipping options. For international deliveries, we navigate through global cargo hubs such as Dubai, Paris, or Singapore, ensuring a smooth customs process, with most deliveries completed in 2-3 weeks, and sometimes even between 7-10 days for expedited arrivals.

Our international express shipping option comes with a $39 charge or is free on orders over $170 and includes full tracking capabilities. Domestic shipping rates vary and are presented at checkout, with the cost included in the domestic product price. This higher rate covers the importation and local handling of generics, promising easier customs navigation and faster delivery. UK customers can expect Royal Mail service, Australian orders are handled by Australia Post, and US deliveries come via USPS, offering access to select products such as ED medications and modafinil—a stimulant approved for narcolepsy that is often prescribed for off-label indications.

SAFE & SECURE PAYMENT OPTIONS

At BuyGenerics, we prioritize your security with a variety of payment options. We accept all major debit/credit cards including MasterCard, American Express, and Visa. US customers can also use Zelle, ACH transfers, eCheck, and Bill Pay for seamless transactions. For our UK and Australian customers, we offer the convenience of Faster Payments, PayID, and Poli, respectively.

PayPal is an additional worldwide payment method, subject to availability and applicable fees due to their strict guidelines for online pharmacy transactions.

For credit card payments, enhanced security measures including KYC verification or phone checks may be implemented to ensure that your purchase is protected. Please note that the availability of credit card payments is dynamic and may vary.

Store

Popular Categories

Top Selling Products

Resources

Helpful Humans

Available 24/7

Step 1: Visit our Help Center for FAQ

Step 2: Contact our friendly Support Team if necessary

Affordable Online Pharmacy & FDA-Approved Meds

Ordering generic medications online is completely legal and safe for your own use in places like the USA, UK, Australia and many other countries. We ship your medications quickly and keep them private, making sure they get to you without any hassle.

DISCREET PACKAGING & RELIABLE DELIVERY

We follow all the rules to make sure your order goes smoothly. Each package has a customs note stating that the items are dietary supplements and 97% of the time they pass without a hitch. If there is ever a mix-up and your package doesn’t show up, we’ll resend it for free, no hassle.

Ordering a lot, like over 500 pills? We’ll break it up into several packages to get it through customs faster.

And here’s a tip to save big: Pay with bitcoin or other cryptocurrencies and automatically get 20% off your purchase, every time – no special codes needed.

- Domestic shipping option now available for US 🇺🇸, UK 🇬🇧 & Australia 🇦🇺

- Free shipping 📦 on orders over $170

- 20% off 💸 for bitcoin and crypto payments